Accommodation

Approximate floor areas are:

| Ground Floor | |

| Retail | 44.41 sq.m. |

| Store Room with WC on return | 10.32 sq.m. |

| First Floor | |

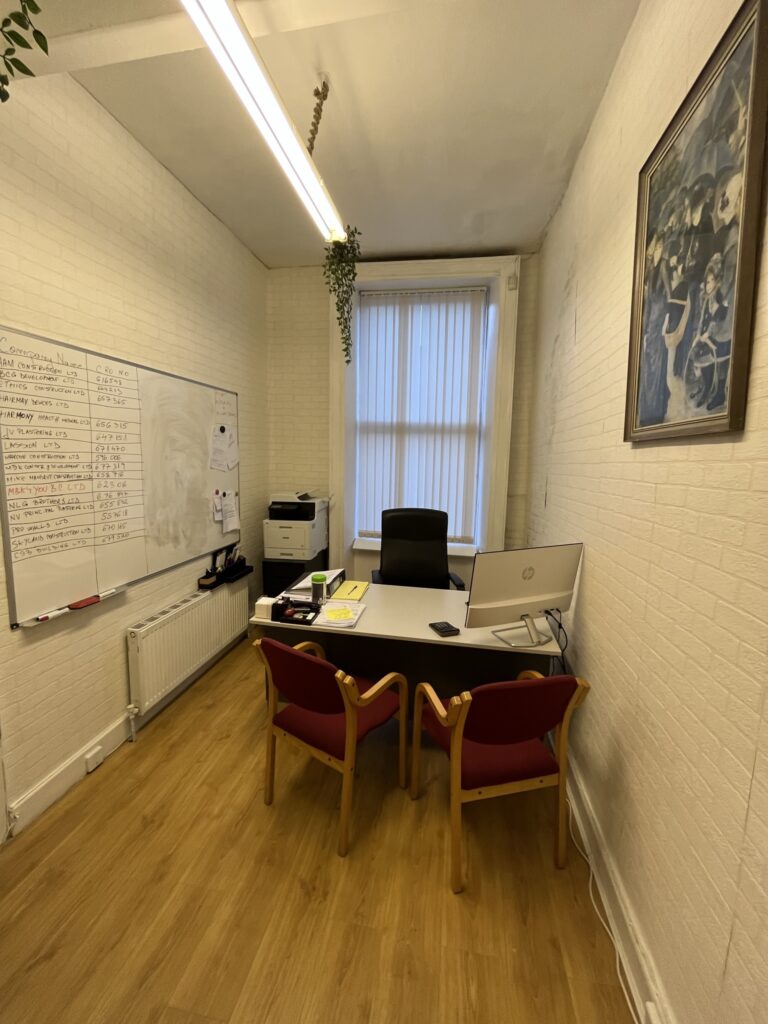

| Front Room with double doors to rear room | 17.18 sq.m. |

| Front Room 2 | 10.92 sq.m. |

| Rear Room | 17.65 sq.m. |

| First Floor Return WC | |

| Second Floor | |

| Front Room 1 | 16.22 sq.m. |

| Front Room 2 | 10.58 sq.m. |

| Rear Room (Residential) with single WC | 16.15 sq.m. |

| Shared Landing / Kitchenette | 4.47 sq.m. |

| Return Kitchenette | 2.61 sq.m. |

| Basement | |

| Front Room | 27.83 sq.m. |

| Store Room 1 | 2.31 sq.m. |

| Store Room 2 | 8.32 sq.m. |

| Kitchenette | 0.74 sq.m. |

| Total net internal area 189.71 sq.m. / 2,042 sq.ft. |

Tenancies

| Unit | Tenant | Term | Commence | Rent (Ex VAT) |

| Ground Floor & Basement | Private individual t/a Hodma Shop | 4 years 9 months (Expired) | 11/11/2017 | €18,000 |

| First Floor | Moneybooks 4 You Business Consulting | 3 years (Expired) | 01/12/2019 | €10,200 |

| Second Floor | Mr. Romel Sultanov / Skin Care Clinic | 2 years 9 months (Expired | 01/03/2019 | €6,000 |

| Second Floor | Private individual (Residential) | TBC | TBC | €6,000 |

Covenant

Details of tenant covenant and guarantors available on request

VAT

The property is not subject to VAT

Proposal

Asking Price: €650,000 exclusive of VAT.

Total passing is €40,200 exclusive of VAT and service charges.

At the asking price of €650,000 this equates to a gross yield of 6.18% or a net yield of 5.62% after standard acquisition costs. Estimated rental value is €58,000 equating to a gross yield of 8.92% or a net yield of 8.11% after costs.

BER: Exempt

Investment Considerations

The property would benefit from some active asset management and has strong reversionary potential.

The estimated market rent for the building is c.€58,000. Reflecting a gross yield of 8.92% & a net yield of 8.11%.

The existing residential tenant can be served notice to vacate the flat. The remainder of the tenants are all over holding and can be renewed to market rent under modern lease terms.